It’s time for a change, wouldn’t you agree?

A few weeks ago I had the privilege of attending Ernst and Young’s Insurance Executive Forum at Conrad Hotel in New York City. The crowd was an incredible mix of industry leaders, innovators, and disruptive InsurTechs, so it’s no surprise that the presentations were as equally engaging as the attendees themselves.

One of the most interesting keynotes from the event was a presentation by Allstate’s President of Personal Lines, Glenn Shapiro. Glenn is an exceptional speaker, and the topics he presented resonated strongly with me due to how closely they aligned with what we do at Livegenic.

Glenn opened with the importance of Disruption - comparing today’s Insurance industry with the Financial / Payments industry of a few years ago. Thanks to the success that industry’s disruptive transformation, we now have easy bank-to-bank transfers, account management with mobile devices, and entirely new tools like Apple Pay. In Insurance however, there is still a resistance to innovate - what Glenn called a “Bubble” - that needs to burst.

For many Insurance organizations, one of the biggest barriers to success is the reliance on outdated processes and procedures. One example that Glenn gave was the number of estimates that a single Adjuster can write in a day: 4 to 5, which is exactly the same as what we’ve seen at Livegenic when speaking with clients and customers.

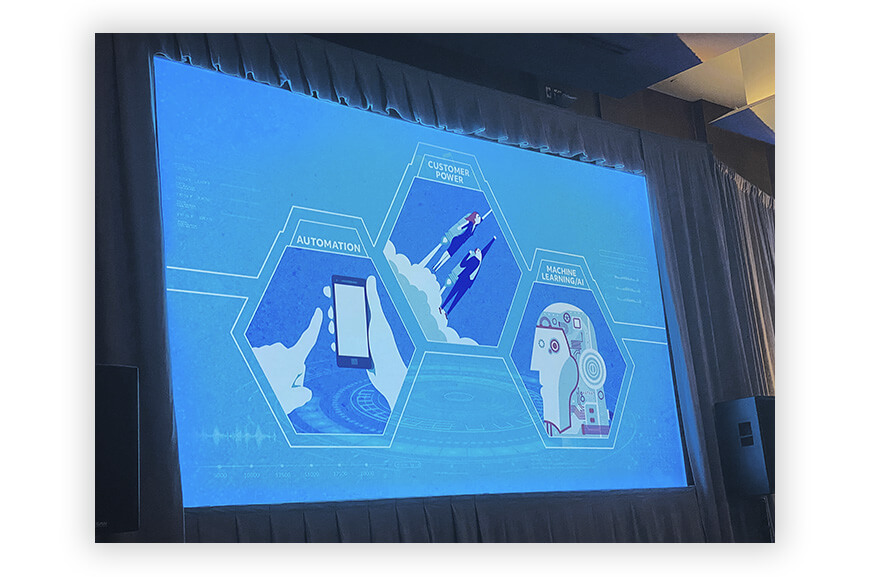

Glenn went on to identify three key avenues to change which can radically improve the Insurance industry: Automation, Customer Power, and Machine Learning.

Automation provides substantial benefits to the claims process. By offering claims handlers the ability to quickly and easily inspect losses through virtual collaboration with policyholders, insurance organizations are able to increase customer satisfaction, minimize costs, and optimize their entire claims process.

Glenn leaned into the success of this approach, mentioning that Allstate now processes 60% of all supplements via Live Video, with the average session taking just 9 minutes to complete.

This leads directly into the next avenue of change: Customer Power. Glenn emphasized the importance of providing customers with tools that enable them to collect photos, videos, and other content on their own. He emphasized that Allstate is able to use photo-based-estimation on 100% of claims, whereas many other carriers utilize it on less than 10% of claims! At Livegenic, we’ve seen the importance and value that self-service brings to the claims process, and our team has built a variety of incredible solutions that enable our clients to achieve those same results.

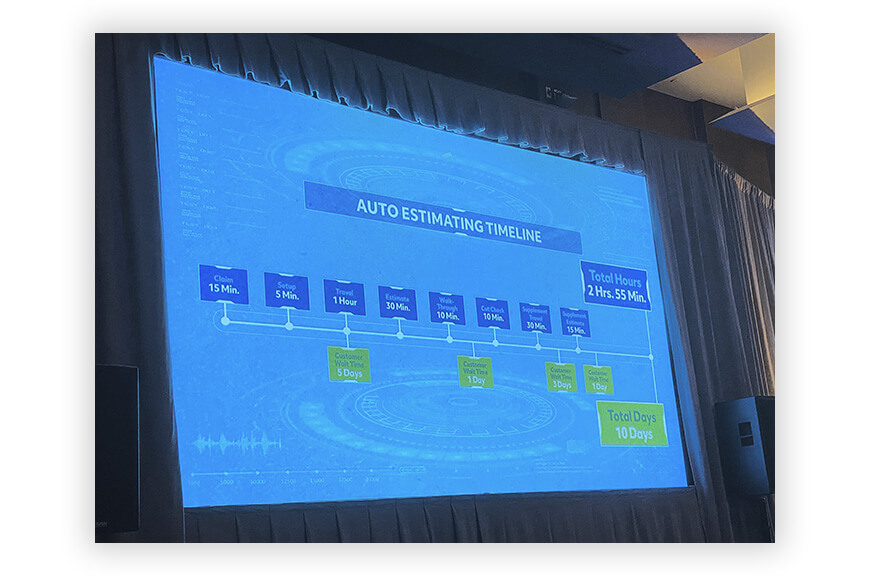

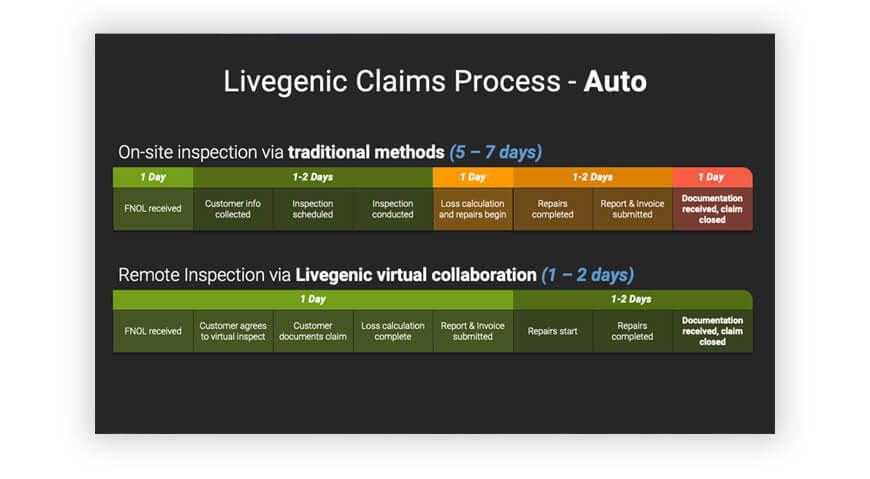

Glenn’s next slide drove his point home even further; it showed a comparison between two timelines that emphasized the benefits that Automation, AI, and Customer Empowerment can have on the Auto Claims process.

I couldn’t help but smile to myself when I saw his slide, as it lined up almost exactly with one of the slides from our own sales deck. It’s exciting to have a 30-year industry veteran confirm that our vision aligns with some of the biggest leaders in the global Insurance market.

Glenn closed out his presentation with a look to the future, and how Machine Learning and Artificial Intelligence can bring tremendous benefits like touchless claims that are received, processed, and completed in less than a day.

I share Glenn’s interest and belief in the power of AI to reshape the claims process - at Livegenic we have already started the process of bringing true AI estimation to our clients through our direct integration with AI Auto Damage Appraisal platforms.

This technology is only going to continue to evolve and improve, and I personally cannot wait to see what the future has in store for the Insurance industry.

Olek Shestakov, Livegenic CEO